This time may well be different

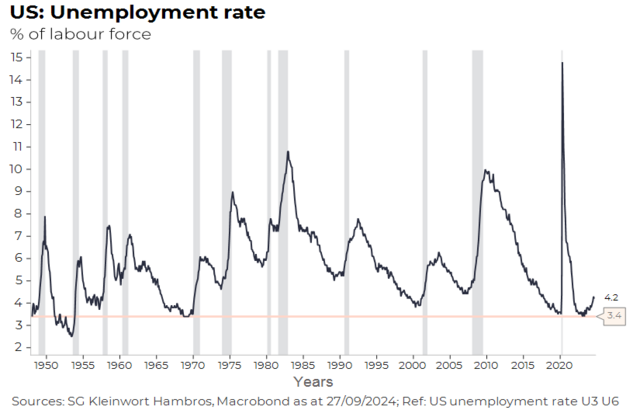

Throughout the summer, global financial markets demonstrated extreme volatility, which was to a large extent caused by the state of the US labour market. Since the beginning of the year, the US unemployment rate has been trending higher, increasing to 4.1%1. Historically, such an increase has coincided with a recession in the US. The markets were thus worried that the higher unemployment rate was signalling a recession was imminent, which would result in lower corporate profits.

This helps explain the global equities market sell-off that occurred in early August and, to a lesser extent, again in early September, following the releases of US Employment reports. But as the saying goes, this time may be different.

The US unemployment rate is still low

The jobless rate has increased but has done so gradually and from a very low base: the unemployment rate hit 3.4% in 2023, a 55 year low1. Moreover, the August rate of 4.1% cannot be deemed "elevated," given the average long-term rate of 5.5% to 6%.

Therefore, the recent rise can be interpreted as a normalisation of what was an overheated market. Additional metrics, like the ratio of the number of job vacancies to unemployed, also suggest that labour market tensions are only easing (not collapsing), reverting to their pre-Covid levels.

It's important to understand why it’s rising

Furthermore, the reasons for the upswing in the unemployment rate do matter. The number of people losing their jobs has increased, however, a large part of the rise comes from an increase in the size of the labour force2. This means that while there are more people unemployed, this is not mainly due to redundancies, but because more people are entering the workforce and are having trouble finding work. This is consistent with a still-tight labour market, not of a recession-type environment.

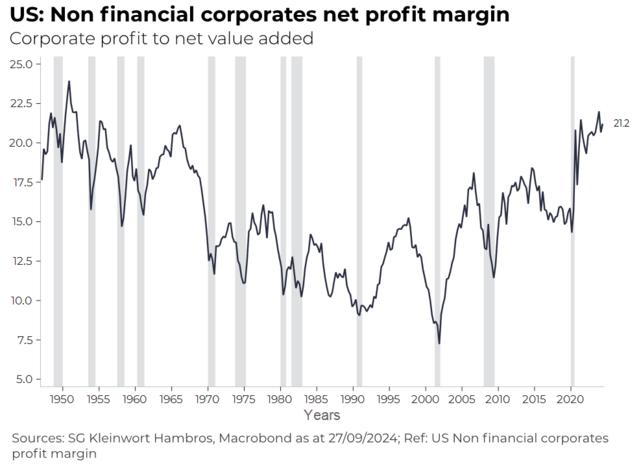

Profit margins point to a soft landing

Finally, the unemployment rate is at best a coincident indicator. Typically, it’s a lagging one, and so predicting a recession using this metric alone is far from ideal. US profit margin levels are a far more reliable - and forward-looking - measure. The explanation for this is straightforward: businesses typically reduce both their workforce and investment spending when profit margins are being squeezed, which eventually triggers a recession.

Despite the current environment of rising interest rates and wage costs, US profit margins are still high – albeit no longer at record levels. As a result, companies do not need to change course quickly. It’s still likely that the US will experience a so-called soft landing, where a period of high growth is followed by a gentle moderation and not a hard recession. If so, this time would indeed be different.

Sources

1 Federal Reserve Board of St Louis, 27 September 2024: https://fred.stlouisfed.org/series/UNRATE

2 US Bureau of Labour Statistics, 6 September 2024: https://www.bls.gov/news.release/empsit.t11.htm

Disclaimers

Important information and Financial Promotion

This document is a marketing communication provided for information purposes and is not investment advice or a recommendation. It is not intended for distribution in or into the United States of America nor directly or indirectly to any U.S. person.

Investment Performance

Investments may be subject to market fluctuations and the price and value of investments and the income derived from them can go down as well as up.

Limitation

Information in this document is believed to be reliable but SG Kleinwort Hambros Bank Limited does not guarantee its completeness or accuracy and it should not be relied on or acted upon without further verification.

Legal and Regulatory Information

This document is issued by SG Kleinwort Hambros Bank Limited which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the UK. The company is incorporated in England & Wales under number 964058 with registered office at One Bank Street, Canary Wharf, London E14 4SG. Services provided by non-UK branches of SG Kleinwort Hambros Bank Limited will be subject to the applicable local regulatory regime, which will differ in some or all respects from that of the UK. Please see the Information Documents on our website for further information: https://www.kleinworthambros.com/en/important-information.

Further information on SG Kleinwort Hambros Bank Limited and its branches including additional legal and regulatory details can be found at: www.kleinworthambros.com.

SG Kleinwort Hambros Bank Limited is part of the wealth management arm of the Societe Generale Group, Societe Generale Private Banking. Societe Generale is a French bank authorised in France by the Autorité de Contrôle Prudentiel et de Résolution, located at 61, rue Taitbout, 75436 Paris Cedex 09, and under the prudential supervision of the European Central Bank ('ECB) . It is also authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

© Copyright the Société Générale Group 2024. All rights reserved.

Approval code CA203/Sept/24.