UK Autumn Budget: a lesser drag on growth, but not a game-changer

Though it has been less than a month, the publication of the UK’s Autumn Budget feels like ancient history, with US politics commanding the front pages of many UK news outlets. But the Budget is still hugely relevant to the UK economy and markets. In this edition of Market Focus we look at the economic and market impact of these government decisions.

A smaller reduction in the deficit than previously planned, but still a reduction

In its first budget, the Labour government has decided to massively increase public spending and investment. Most of the additional spending will go to the National Health Service (NHS) and education, but also to transport and defence. This increase in spending is only partly offset by a series of tax increases (employers’ National Insurance (NI) contributions but also Capital Gains Tax (CGT), levies on soft drinks and vaping, Value Added Tax (VAT) on private schools, etc.). As a result, public sector borrowing requirements (i.e. planned bond issuances) over the next five years are likely to be significantly higher than previously anticipated.

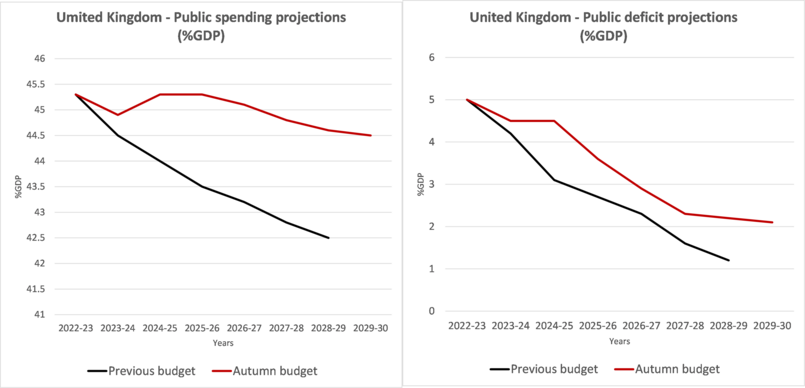

The new budget is thus completely different (in spirit and composition) from the previous budget. However, it does not mark a change in the overall fiscal stance; only a change in its size. Instead of a major fiscal consolidation (reduced deficit as a share of GDP) over the next five years, the government is now planning a more modest one. In other words, there will still be a drag on growth from a tighter fiscal policy; just of a smaller magnitude. Two metrics can help illustrate this point:

- The previous government had planned to significantly reduce public spending (as a share of GDP) over a five-year horizon, from what was 44.9% of GDP for 2023-24 to 42.5% by 2028-29. The new budget envisages a much higher spending ratio (44.5% of GDP by 2028-29), but still marking a slight decline.

- Similarly, the projected public deficit (the difference between taxes and government spending) is larger than the previous government had projected (-1.2% of GDP by 2028-29 compared to -2.2% previously), but still declining in comparison with 2023-24 (where it was -4.5% of GDP).

Source: SG Kleinwort Hambros, Office for Budget Responsibility as of 30/10/2024

A boost to growth in the short-term, but fewer rate cuts

The measures included in the Autumn budget should provide some relief to economic growth in the short-term, thanks to this lessened fiscal drag. However, the medium-term impact is more ambiguous. On one hand, the increase in employers’ national contributions and in the minimum wage could weigh on corporate profitability and ultimately on private investment and employment. On the other hand, as seen in the US or Southern Europe, higher public investment could have positive knock-on effect on private investment – a phenomenon economists refer to as “crowding in”.

This has important implications for monetary policy. Before the budget announcement, markets were expecting the Bank of England (BoE) to make two interest rate cuts this quarter. But the smaller fiscal drag limits the BoE’s room for manoeuvre and reinforces its previously stated cautious stance. Therefore, after the November cut, it seems increasingly likely that the BoE will wait until early February before potentially easing further.

Thankfully, not another mini-Budget

The reaction of the UK government bond markets has been much more muted than after Truss’s mini-Budget. Bond yields have thus far risen by a maximum of 22 basis points (0.22%) since Budget-day, compared with around 100 basis points at the same point in 2022. Three factors help explain this.

- First, the current measures are only partly unfunded.

- Second, public investment – the main source of the fiscal loosening in this budget – could be seen as positive for long-term growth (and thus ultimately lead to lower borrowing needs).

- Third, the economic environment is completely different from that of 2022: back then, high and rising inflationary pressures forced the BoE to raise interest rates. Nowadays, inflation is declining and is close to the 2% target, allowing the BoE to cut interest rates, although moderately.

Source: SG Kleinwort Hambros, Macrobond as of 15/11/2024

In short, the new budget will lead to a larger deficit, greater borrowing needs, and higher tax rates than planned by the previous government, but not excessively so. Its impact on short-term growth should prove more positive (or at least less negative). As a result, the BoE will no longer need to (or perhaps no longer be able to) aggressively reduce its key interest rates.

Important Information

This document is a marketing communication provided for information purposes and is not investment advice or a recommendation. It is not intended for distribution in or into the United States of America nor directly or indirectly to any U.S. person.

Limitation

Information in this document is believed to be reliable but SG Kleinwort Hambros Bank Limited does not guarantee its completeness or accuracy and it should not be relied on or acted upon without further verification.

Marketing Opt Out

If you do not wish to receive this document in the future, please let your Private Banker know or call us on +44 (0)20 7597 3000. Telephone calls may be monitored or recorded.

Legal and Regulatory Information

This document is issued by SG Kleinwort Hambros Bank Limited which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the UK. The company is incorporated in England & Wales under number 964058 with registered office at One Bank Street, Canary Wharf, London E14 4SG. Services provided by non-UK branches of SG Kleinwort Hambros Bank Limited will be subject to the applicable local regulatory regime, which will differ in some or all respects from that of the UK. Please see the Information Documents on our website for further information: www.kleinworthambros.com/en/important-information.

Group Information

Further information on SG Kleinwort Hambros Bank Limited and its branches including additional legal and regulatory details can be found at: www.kleinworthambros.com.

SG Kleinwort Hambros Bank Limited is part of the wealth management arm of the Societe Generale Group, Societe Generale Private Banking. Societe Generale is a French bank authorised in France by the Autorité de Contrôle Prudentiel et de Résolution, located at 61, rue Taitbout, 75436 Paris Cedex 09, and under the prudential supervision of the European Central Bank ('ECB'). It is also authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Approval code CA272/Nov/24